By Jerry Love, Director of Planned Giving

ALEXANDRIA – Recently I was visiting with a friend whom I’ve known for a number of years. He is retired from a full time church staff position but still actively involved in ministry.

He asked me a question that caught me by surprise, given his involvement in Baptist life. “What does the Louisiana Baptist Foundation do?”

As I attempted to give him a quick explanation, I wondered how many others understood the work of the Foundation.

As an agency of the Louisiana Baptist Convention, the Foundation encourages and assists with gifts that benefit Louisiana Baptist churches, and Baptist institutions that are affiliated with the LBC or the Southern Baptist Convention. The church or organization is selected by the donor.

Sounds pretty straightforward but giving can be complicated.

The LBF typically does not receive gifts for its own benefit. The beneficiary of gifts directed to the Foundation, whether a “pass-through” gift or an endowment managed by the Foundation, is a church or Baptist purpose selected by the donor.

There are many ways to give, some as simple as writing a check while other gifts can be fairly complicated.

The Louisiana Baptist Foundation can help a donor determine the best manner and the most appropriate asset to gift.

OUTRIGHT GIFTS

The most basic gift is a transfer of an asset directly to the ministry selected. These outright gifts can be made in a number of ways: cash, securities, real estate, or personal property.

The most common way to make an immediate gift is by writing a check. This type of cash gift provides immediate liquidity for charity and generates a charitable income tax deduction for the donor in the year of the gift.

However, giving cash is not always the best option for giving.

Gifts of stocks, bonds or mutual funds can provide greater tax benefits.

If you have owned securities for more than one year and the fair market value has increased since you purchased them, you can avoid capital gains tax and receive a charitable income tax deduction equal to the fair market value.

A gift of real estate that has been held for more than a year also has the advantage of providing you with a charitable deduction, as well as bypassing capital gains tax on the appreciation.

Selected artwork, books and antiques are examples of gifts of personal property that can, in certain situations, be an appropriate gift.

Rules for deducting these types of gifts can be complicated.

To ensure that any tangible personal property qualifies for a favorable charitable tax deduction, it’s important make a note of those items and discuss them with a qualified advisor.

The term “planned gifts” refers to specific strategies that benefit a ministry or charity at some point in the future, and may offer immediate benefits to the donor.

Bequests through a well-planned Last Will and Testament are a primary way to care for family members while providing a gift that will benefit God’s kingdom.

A specific bequest such as dollar amount, a particular piece of property or a certain percentage of the estate can be stated in a Will to benefit ministry.

Another strategy is to meet the needs of family members and leave the remainder, or the “leftovers,” to benefit a ministry organization.

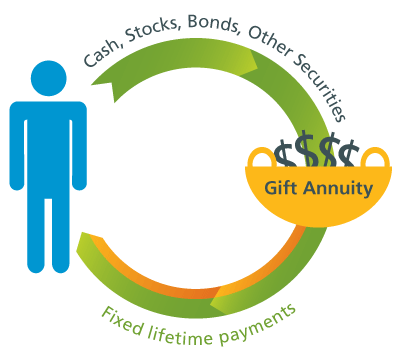

There are several other planned giving options that can provide income and potential tax benefits to donors. Charitable Gift Annuities and Charitable Remainder Trusts, though different in form, can each provide lifetime income to the donor or donor’s family while providing funds to further the Gospel in the future. Each of these can provide tax advantages in addition to a charitable income tax deduction.

A Donor Advised Fund is another specialized planned gift that allows the donor to make a charitable contribution currently, receive an income tax deduction in the year the gift is made and then “advise” the fund how the money is to be used in the future.

This allows several benefits to the donor: tax planning, a ready source of funds for charitable gifts, satisfying gifts to multiple ministries with one contribution to the donor advised fund.

The donor may also choose to remain anonymous when using a donor advised fund to support ministry.

The LBF website, www.LBFinfo.org, provides information, illustrations and tools regarding the gifts mentioned above.

There are steps that we invite you to take in preparation for any giving situation.

First we encourage you to pray about God’s purpose for the assets He has entrusted to your care.

Our website has a section called “WHY GIVE/Achieving God’s Purposes for Your Life” that may be a useful guide.

Next, make a list of your assets, the things, possessions or “stuff” God has entrusted to you. You can visit the ESTATE STEWARDSHIP/Gift Options section of our website to get an idea of the types of assets that can be gifted and more explanation of the methods of giving that are available.

Finally, meet with a qualified estate planning professional.

This person should listen to the goals you have identified and help form a plan of action to help you efficiently achieve those goals.

Check with your legal and/or tax advisor. The Louisiana Baptist Foundation staff is always ready to assist in this area as well.

For more information please call 877.523.4636 or visit our website at www.LBFinfo.org.